Stock Market Week 50/25: RENIXX in the Red - Array Technologies and Nordex Rise Double Digits - Bloom Energy Under Pressure

Münster (Germany) - The directionless movement of the penultimate trading week largely continued last week for the RENIXX. Early Friday afternoon, the RENIXX was trading at the previous week’s level but then turned negative. Overall, the market remains volatile at the individual stock level, with large fluctuations.

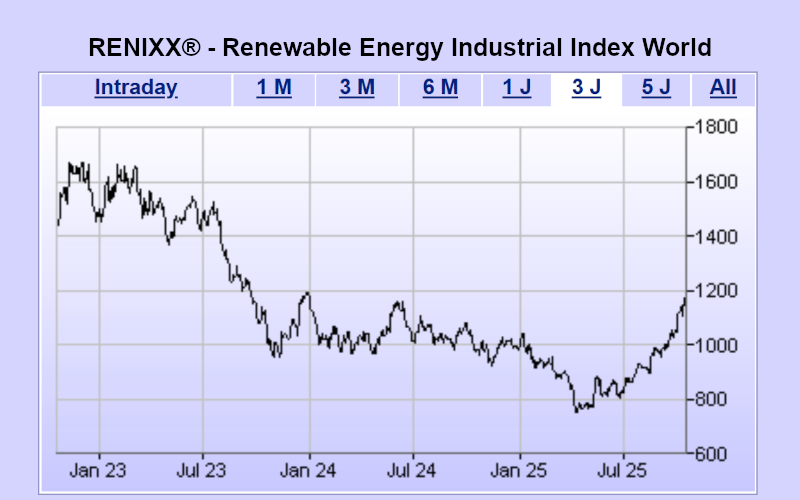

Technical Situation: RENIXX trapped in the range between 1,000 and 1,200 points

From the end of 2023 until January 2025, the RENIXX moved sideways within a range of 1,000 to 1,200 points. The subsequent drop to 748 points marked a significant interim low and still represents the key support zone in the long-term chart.

With increasing volatility, the index recently rose to just under 1,300 points, reaching the upper edge of the previous trading range. Profit-taking then pushed the index back down significantly, at times near the 1,000-point mark. After a counter-move and a neutral sideways movement last week, the RENIXX fell again last week. Only a breakout above 1,200 points or another drop below the 1,000-point mark would redefine the overall technical situation. For the year 2025, based on Friday’s closing price, the RENIXX now stands at a 15.1% gain (previous week: +18.4%).

Company News Week 50/25

Nordex in demand in France and Belgium - Conditional mega-order in the USA

Nordex has secured additional large orders. In France and Belgium, Nordex received orders totaling 102 MW. From the USA comes a conditional order for more than 1,000 MW. The order in the U.S. state of Iowa is not in conflict with the Trump decree on the planning freeze for wind turbines. The Trump decree only applies to federal U.S. areas (including most offshore waters) and does not affect areas under state jurisdiction. Nordex shares surged last week to a new yearly high, closing up 11.7% at €28.88.

Scatec launches second phase of Mmadinare solar park in Botswana

Scatec has started commercial operations for the second 60 MW phase of the 120 MW Mmadinare solar cluster in Botswana. The solar park is Scatec’s first project in Botswana, with the first phase operational since March this year. The plant generates predictable revenues through a 25-year power purchase agreement (PPA) with the national utility, Botswana Power Corporation. Scatec remains the sole owner but plans to reduce its long-term economic stakes by bringing in additional capital partners. Scatec shares ended the week down 1.7% at €8.45.

RENIXX starts the week in the red

At the start of the new trading week, the RENIXX edged slightly lower. The biggest losses yesterday were recorded by Meridian Energy, Solaredge, Daqo New Energy, Array Technologies, and Bloom Energy. Gains were seen for Grenergy Renovables, Goldwind, EDP Renewables, Nordex, and ERG S.p.a.

About the global RENIXX World stock index

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energies and the oldest global stock market barometer for this industrial future sector. It covers wind, solar, bioenergy, geothermal, hydro, e-mobility, hydrogen, and fuel cells.

The index includes 30 international companies with the highest free-float market capitalization and reflects both the performance and global market development of the renewable energy industry.

The RENIXX was launched on 1 May 2006 with a base value of 1,000 points; a back-calculation to 2002 was carried out. It is available through leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 16 Dec 2025