Stock Market Week 02/26: RENIXX 2026 Gets Off to a Strong Start - Bloom Energy’s AEP Deal Sparks Price Hopes - Nordex with 1.4 GW Major Orders - Ormat: First Solar-Plus-Storage Project - Canadian Solar Under Pressure

Münster (Germany) - The RENIXX closed the 2025 trading year with a price gain of 15.1 percent. At the start of the new year, the RENIXX continues its upward trend. Last week, the focus was on the U.S. fuel cell and hydrogen company Bloom Energy. Nordex also showed strong performance.

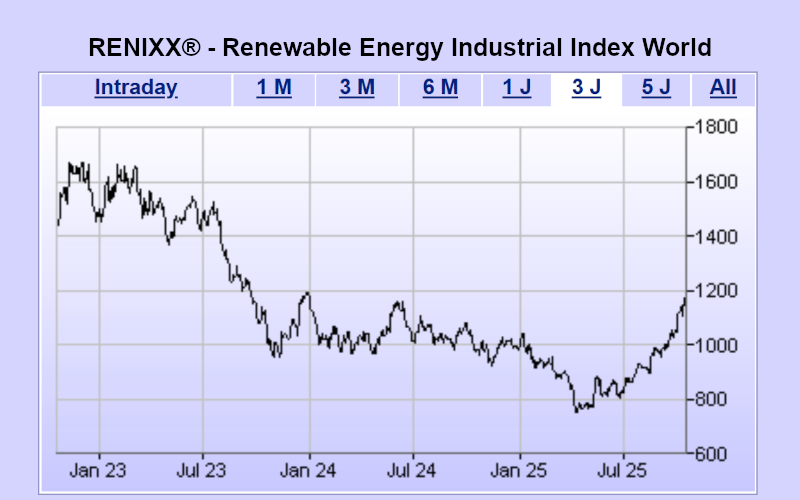

Technical Situation: RENIXX Remains Stable in the 1,000–1,200 Point Range

From the end of 2023 to early January 2025, the RENIXX moved in a pronounced sideways range between 1,000 and 1,200 points. The subsequent drop to 748 points in 2025 marked a significant interim low and an important turning point. This level continues to form the central support zone in the long-term chart.

With increasing volatility, the index temporarily rose to just under 1,300 points, reaching the upper end of the previous trading range once again. Profit-taking then led to a significant correction, at times approaching the 1,000-point mark. After a subsequent rebound, a neutral sideways phase currently dominates, albeit with a slightly positive tendency.

A sustainable breakout above 1,200 points or a renewed fall below the 1,000-point threshold would redefine the overall technical situation.

Company News Week 02/26

AEP Confirms Major Order: Bloom Energy Share Price Soars

American Electric Power (AEP) has, through an unregulated subsidiary, signed an unconditional purchase agreement for a substantial portion of its existing option on solid oxide fuel cells from Bloom Energy. The contract volume amounts to around USD 2.65 billion (approx. EUR 2.45 billion). The agreement is based on a 2024 deal for an initial 100 MW with an option for an additional 900 MW. Bloom Energy shares rose by about 38.2% last week to EUR 115.78.

Nordex Scores with Major Orders from Canada and Europe

The Nordex Group reports a strong start to the year with significant orders. This week, the wind turbine manufacturer announced major contracts from Canada and several European countries with a total capacity of nearly 1,400 MW. The orders come from Canada, Germany, France, Spain, Portugal, and Belgium. The company is thus continuing its growth trajectory in Europe and North America, primarily using turbines from the Delta4000 platform. The stock continues its upward trend, gaining 7.3% to EUR 32.26.

Ormat Launches First Solar-and-Storage Hybrid Project in California

Ormat Technologies has commenced commercial operations of its Arrowleaf solar-and-battery storage project in California. This is the company’s first hybrid solar-plus-storage project and a strategic step to expand its business beyond geothermal energy. The facility combines approximately 42 MW of solar capacity with a four-hour battery storage system rated at 35 MW, or 140 MWh storage capacity. Ormat shares closed up 2.3% at EUR 98.98.

Canadian Solar Stock Plummets Following Bond Announcement

Canadian Solar announced the pricing of its previously announced issuance of USD 200 million in senior convertible bonds. The company expects the offering to close around January 13, 2026. Following the announcement, the stock dropped sharply last week. With a decline of 23.5% to EUR 16.61, Canadian Solar ranked last in the RENIXX ranking. Investors were concerned about potential dilution, compounded by challenging market and sector conditions.

RENIXX Slightly Down at the Start of the Week

At the start of the new trading week, the RENIXX fell slightly. Early losses were recorded by Bloom Energy, Vestas, Plug Power, Ørsted, and Green Plains. Gains were seen for Scatec, Goldwind, Jinkosolar, Xpeng, and BYD.

About the Global RENIXX World Index

The RENIXX® World (Renewable Energy Industrial Index, ISIN: DE000RENX014) is the world’s first stock index for renewable energy and the oldest global benchmark for this industrial future sector. It covers wind energy, solar energy, bioenergy, geothermal energy, hydropower, e-mobility, hydrogen, and fuel cells.

The index includes 30 international companies with the highest free-float market capitalization and reflects both the performance and the global market development of the renewable energy sector.

The RENIXX launched on May 1, 2006, with a base value of 1,000 points; a back calculation to 2002 has been made. The index is available through leading financial media and data providers such as Bloomberg, Reuters, Financial Times, BlackRock (Aladdin), and Wallstreet Online.

Source: IWR Online, 12 Jan 2026